Story: Lisa Sollie

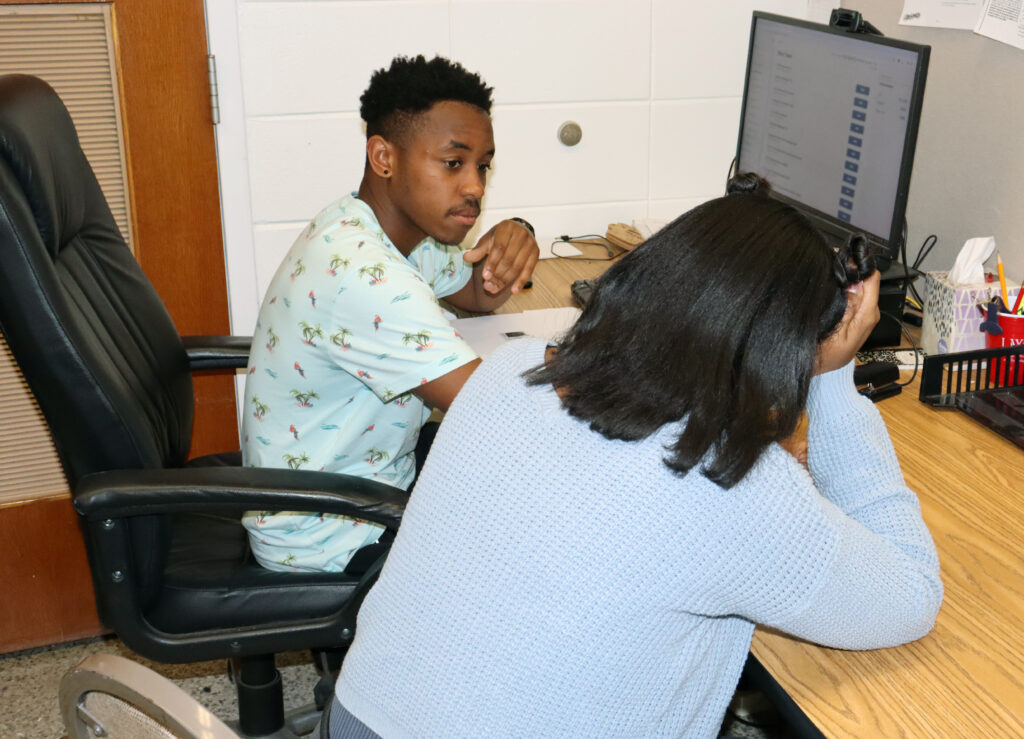

For more than 20 years, the University of West Alabama has offered a hands-on learning opportunity for accounting students to prepare individual state and federal income tax returns at no charge to the tax payer through the Volunteer Income Tax Assistance (VITA) program which receives grant assistance from the Internal Revenue Service (IRS) through ImpactAmerica.

According to Sharon Stipe, UWA accounting professor and VITA site coordinator, the community outreach program sees approximately 300 taxpayers each filing season. Volunteers, including UWA accounting students and faculty, average preparation of more than 260 individual state and federal income tax returns each year. The University’s VITA clinic primarily services residents in Choctaw, Greene, Marengo, Pickens and Sumter counties. Stipe said that residents of east Mississippi are also welcome.

“Each year, VITA offers an incredible opportunity for our accounting students to gain practical real-world experience, provide a meaningful service to the community and receive course credit for participating in the VITA practicum,” noted Stipe, “and it also looks great on their resumes.”

Olivia Williams, a fourth-year accounting major from Valley, Alabama, who participated in the VITA program as a tax preparer during the spring semester of her junior year, believes the benefits are immeasurable.

“Working hands-on with tax clients reviewing their documents and answering income tax and finance related questions helped me gain a better understanding of how to prepare returns. I learned numerous tax laws and applied federal, state and local codes to ensure tax compliance,” said Williams. “Participating in VITA was also the best preparation for my first internship as a revenue tax auditor at the Alabama Department of Revenue’s individual income tax department in the summer of 2023. During meetings with taxpayers that summer, I knew what questions to ask and how to best explain tax return results to my clients and their representatives.”

Free income tax return preparation and e-filing services through the VITA clinic are by appointment only and can be made by calling the clinic at (205) 652-3846 and leave a message with callback information or email vita@uwa.edu.

Appointments are available Mondays from 9:00 a.m. until 11:00 a.m. and 2:00 p.m. until 6:00p.m., Tuesdays and Thursdays from 11a.m. until 12 noon and Wednesdays from 9:00 a.m. until 1:00 p.m.